TL;DR — What the $200 Incubator Plan

Doesn’t Cover

Your monthly fee already gives you day-to-day bookkeeping, one business return, one personal return, and unlimited “quick-question” support.

Everything else falls into one of these buckets and is billable only if / when you need it:

🕰️

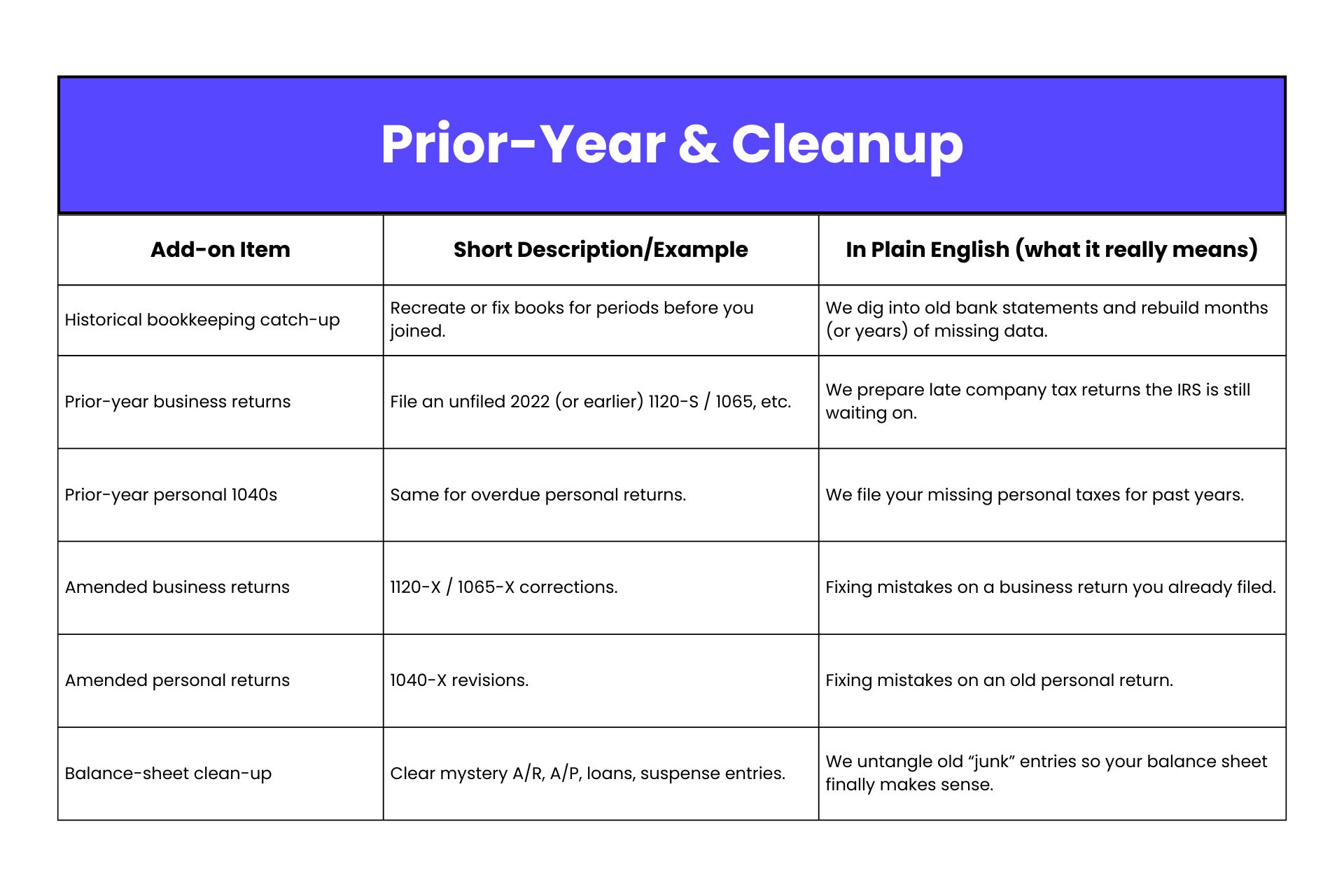

Catch-Up & Old Stuff

Rebuilding messy prior books, filing or amending past-year returns.

💸

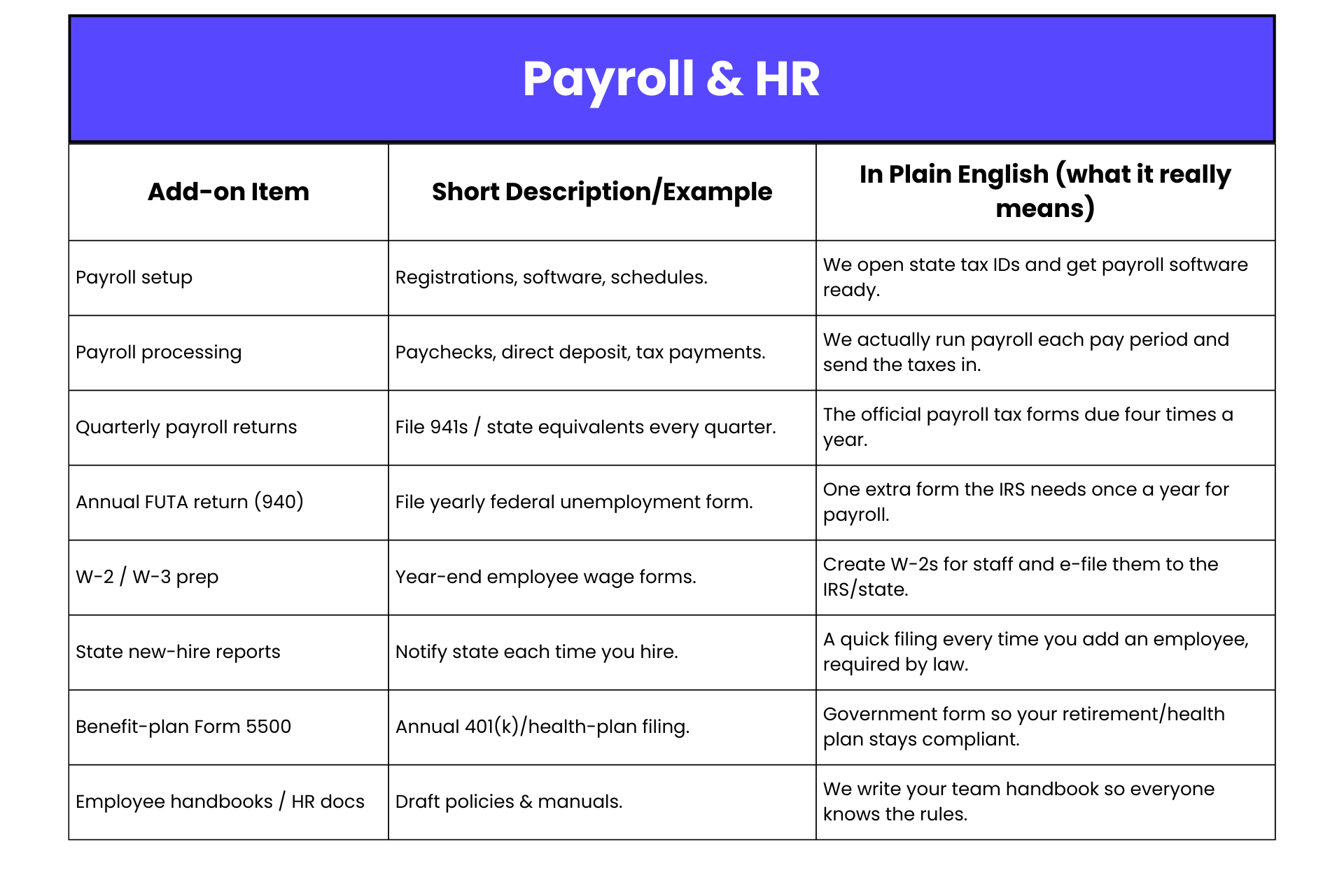

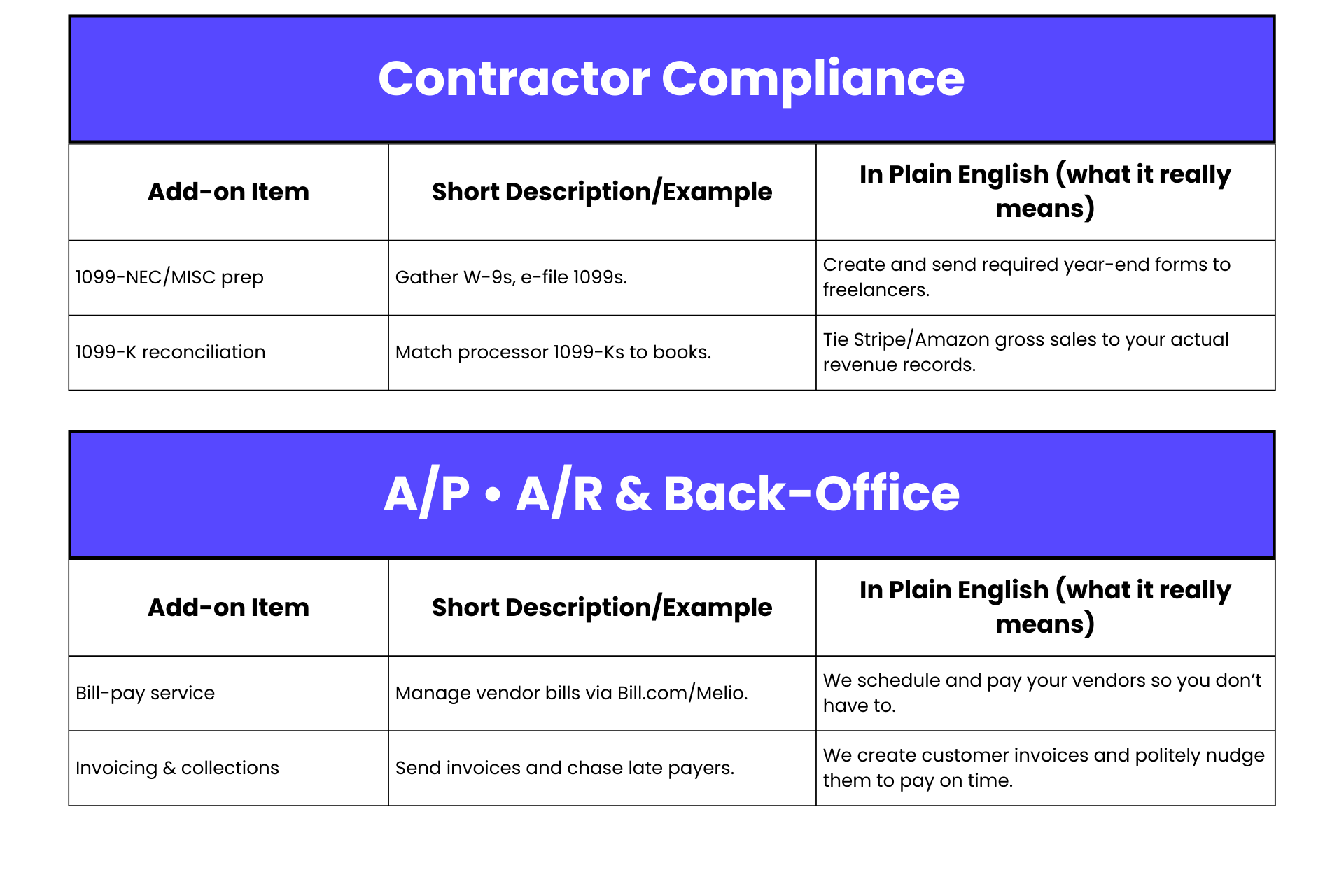

Payroll & Contractors

Pay runs, payroll tax forms, W-2s, 1099s, benefit-plan filings.

🛍️

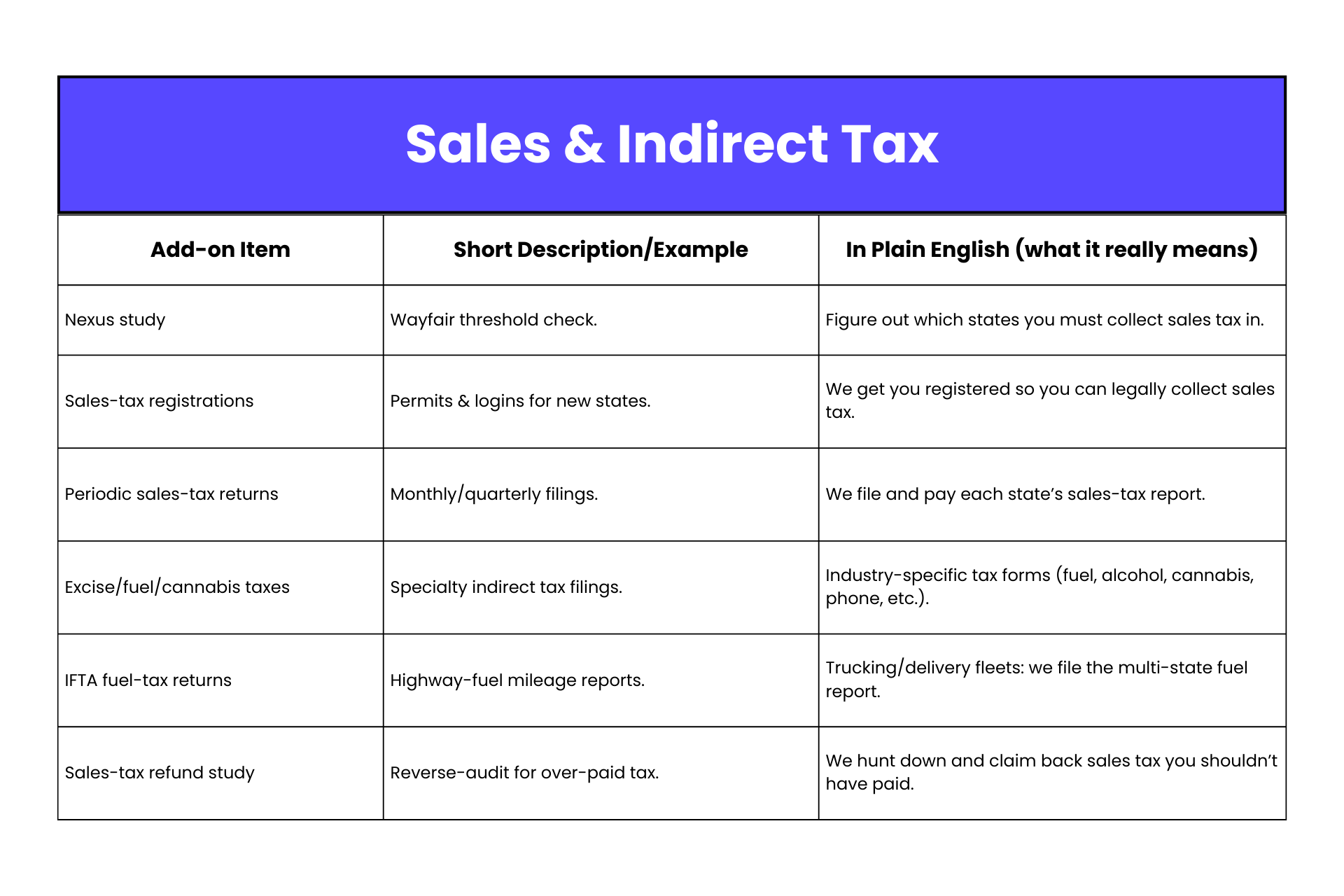

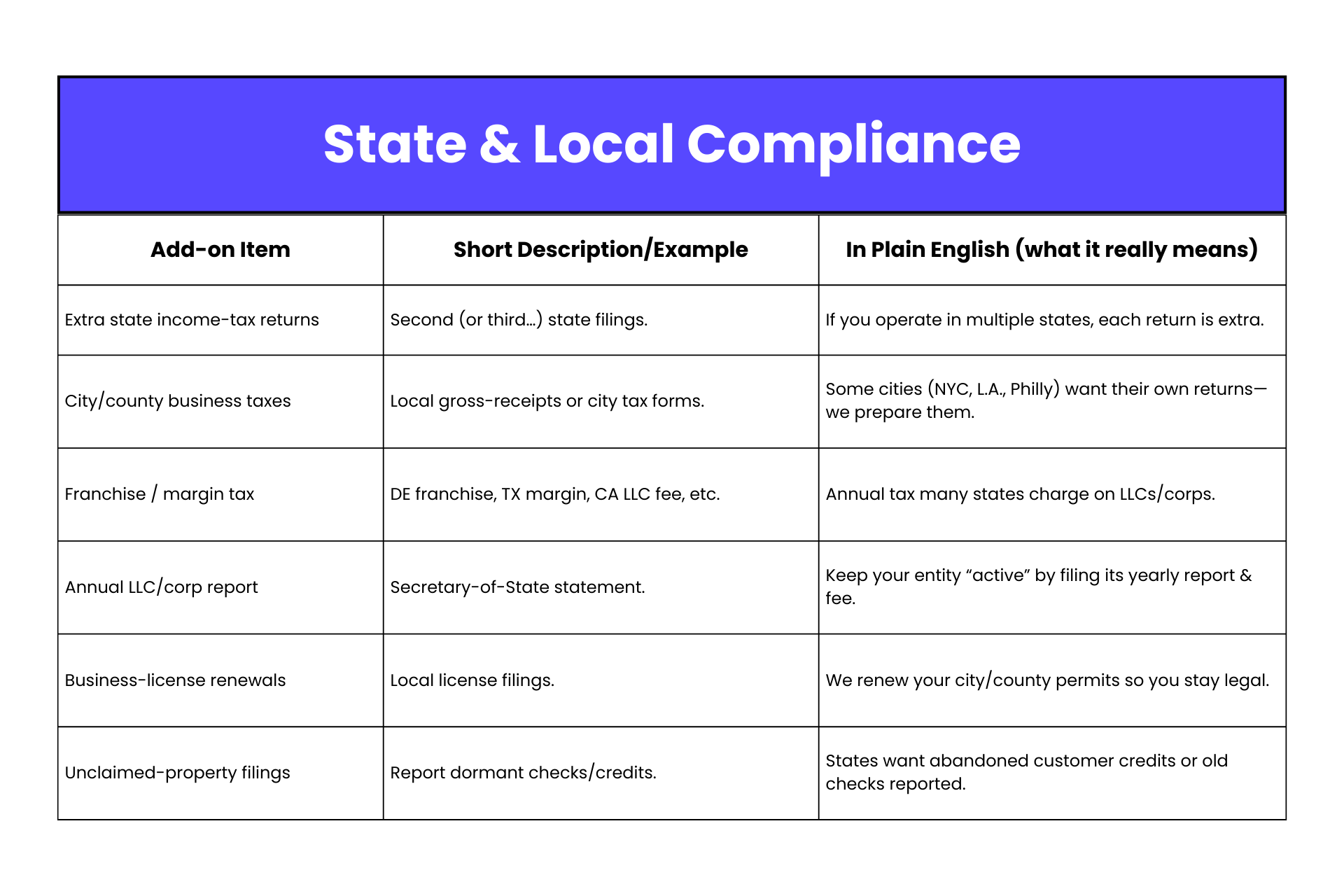

Sales-Tax & Extra States

Nexus studies, sales-tax permits/returns, additional state income-tax filings.

👥

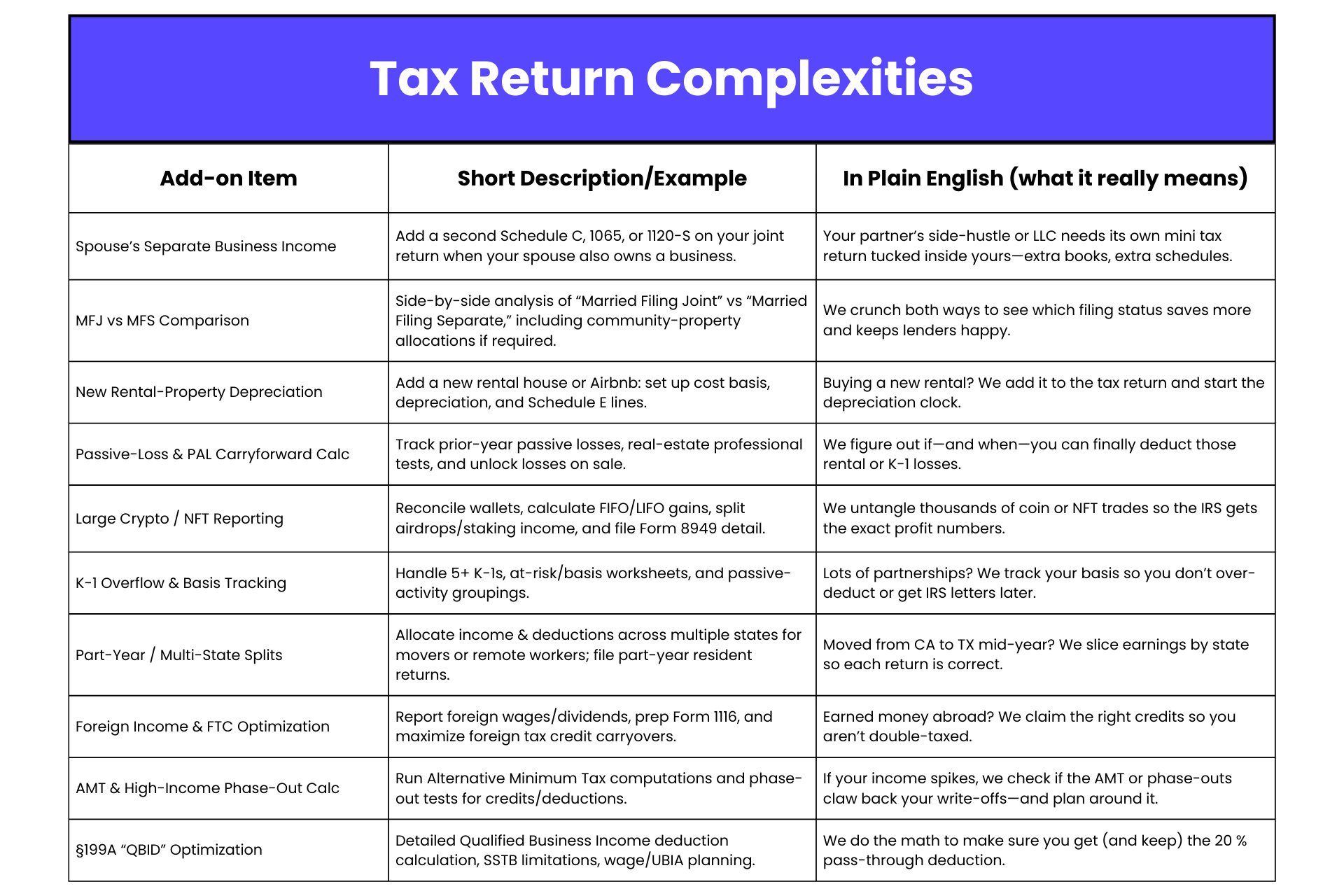

Extra Entities / Spouse’s Biz

Second LLC, S-corp, partnership, or your spouse’s separate company on the joint return.

🏠

Rental & Real-Estate Extras

More than three rentals, 1031 exchanges, cost-seg studies, depreciation recapture.

📊

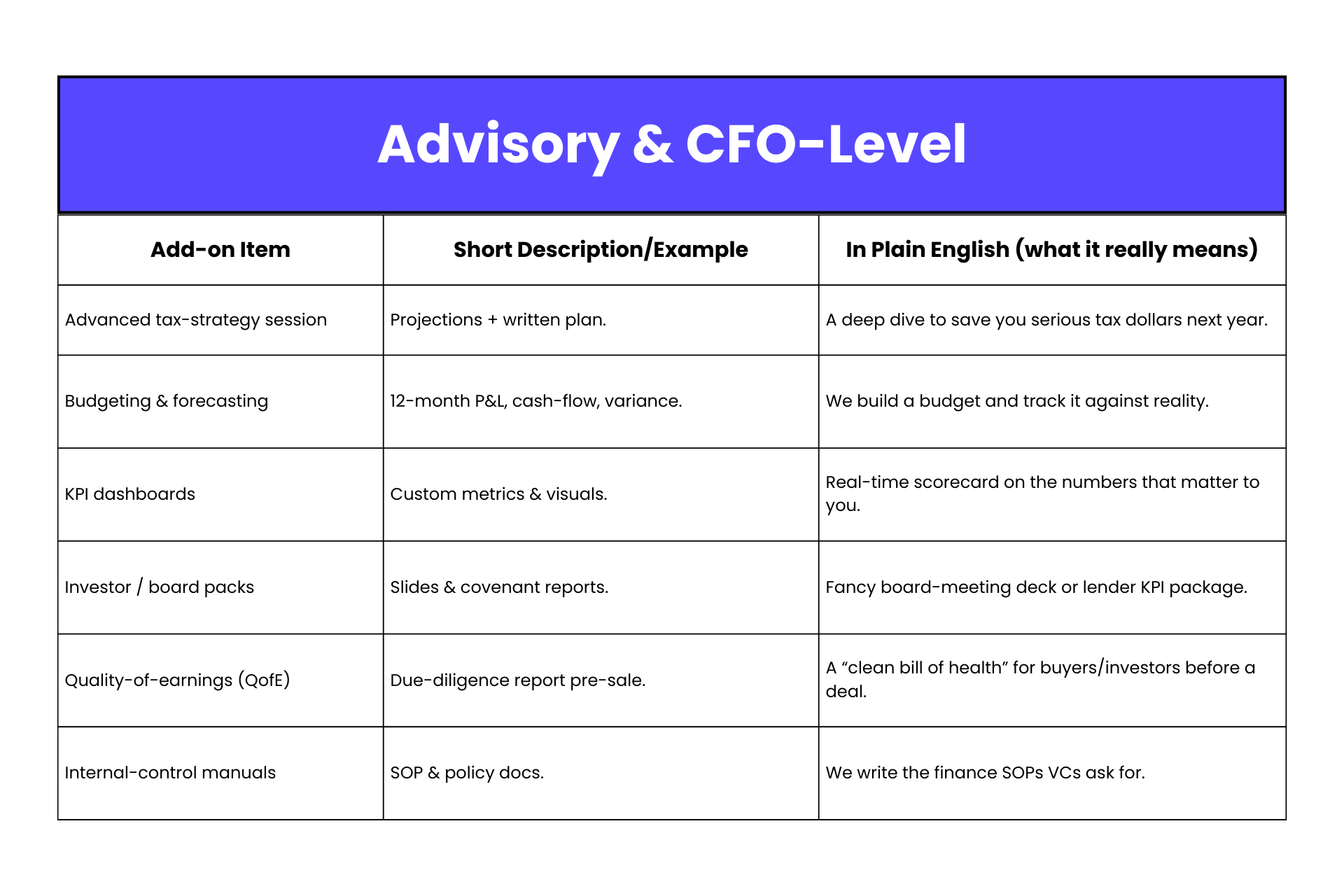

Deep Advisory & CFO Work

Detailed tax planning, cash-flow forecasts, budgets, KPI dashboards, investor decks.

🛡️

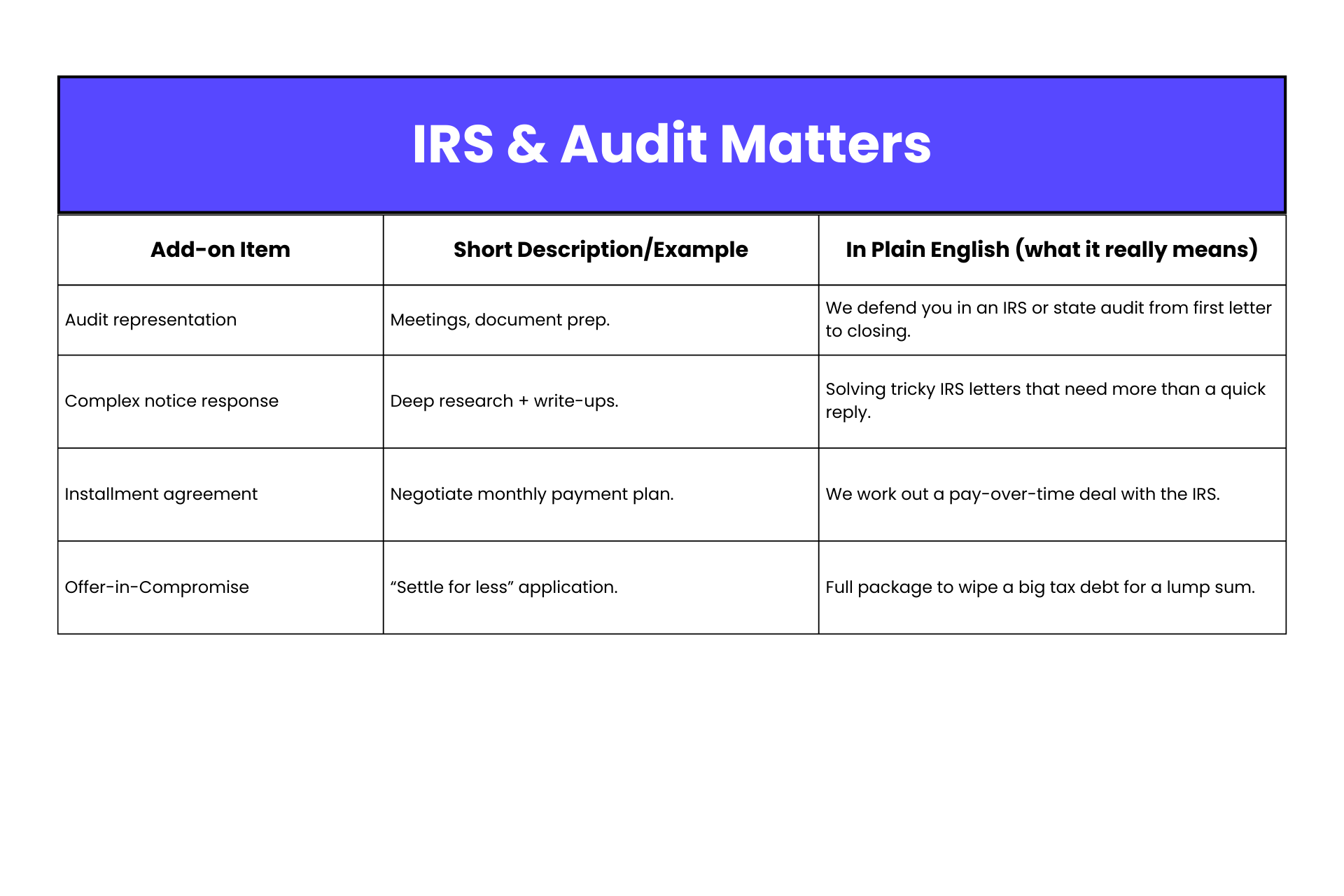

Audits & IRS Notices

Full audit defense or complex notice research (beyond a quick clarification).

🌐

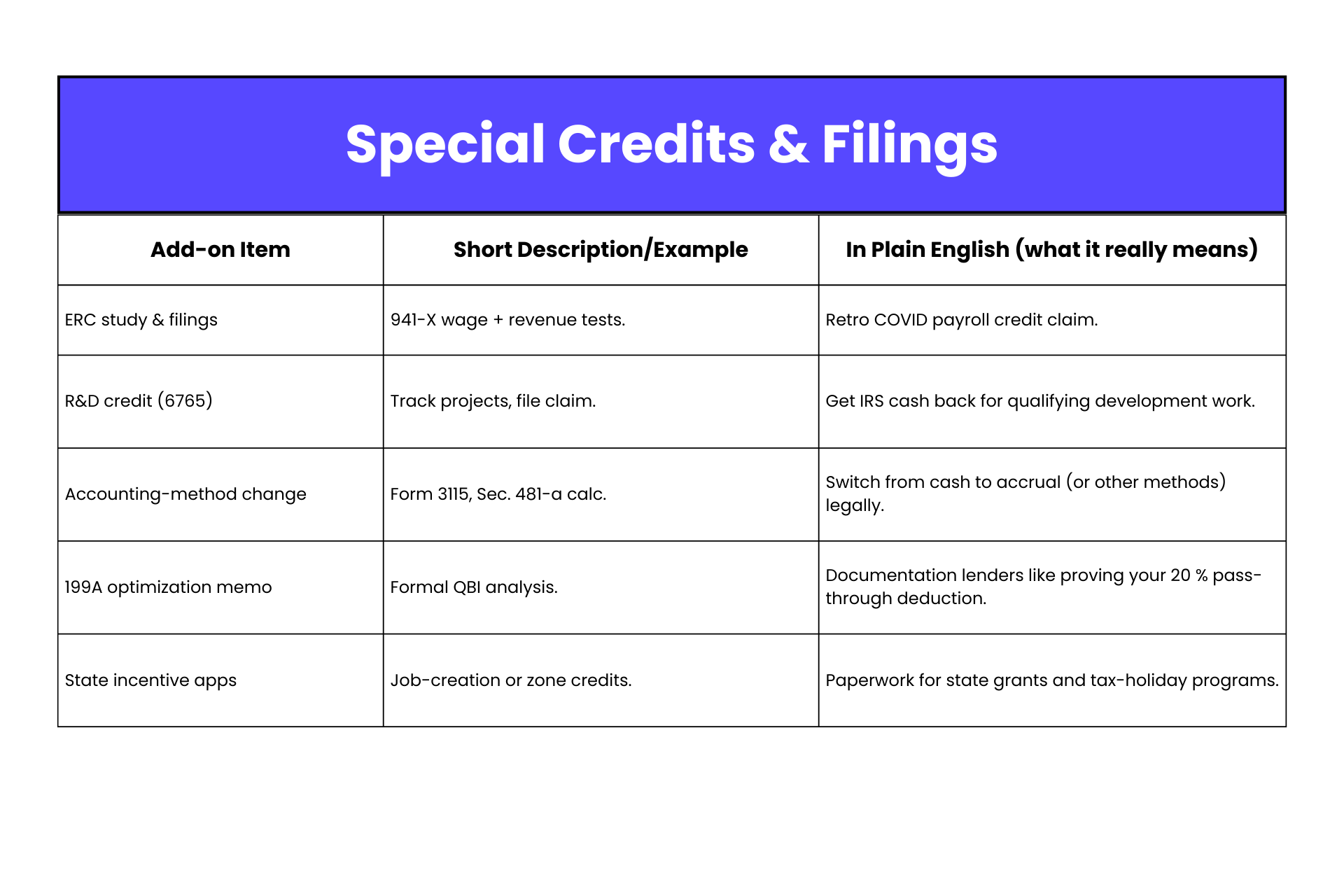

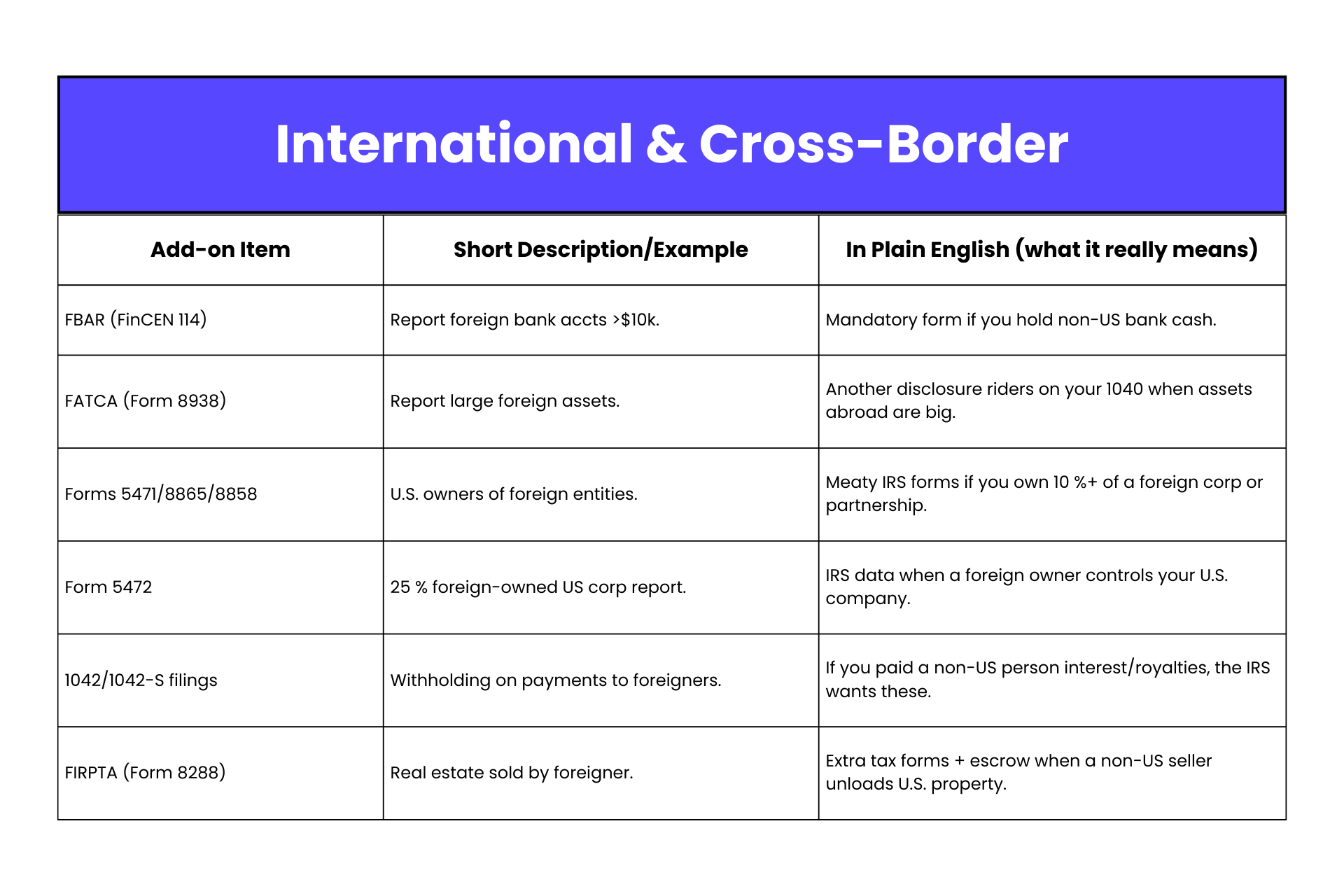

International & Specialty Filings

FBAR/FATCA, foreign-owner forms, ERC/R&D studies, crypto or high-volume stock gains.

📑

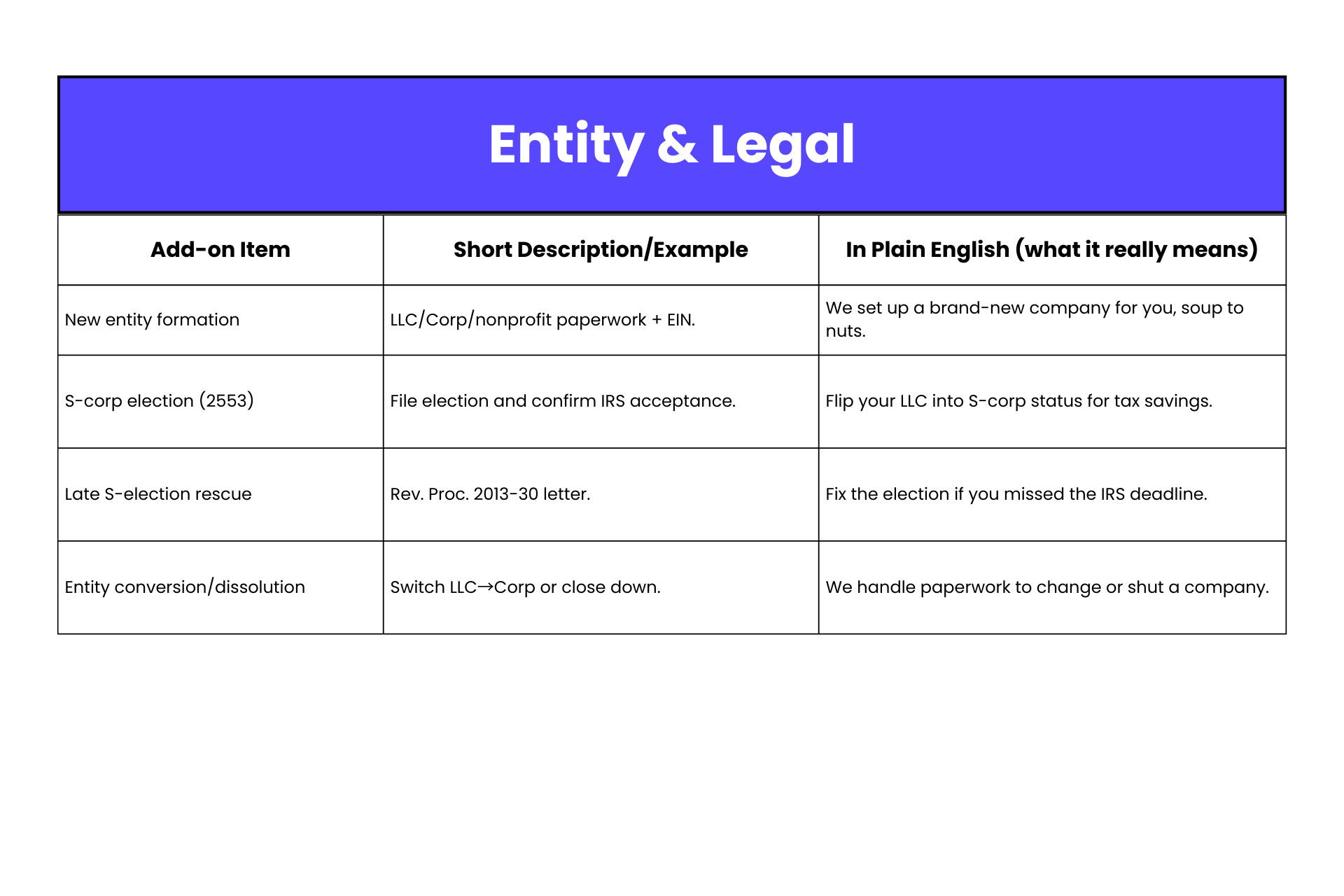

Entity Paperwork

New LLC formation, S-corp election, conversions, dissolutions, franchise reports.

🗂️

One-Off Admin Tasks

Workers-comp audits, bill-pay, invoicing, mortgage comfort letters, Census surveys.